Financial outlook: Cracks in the dancefloor

Building a corner-stone of mud!

We live in unprecedented times! By pushing interest rates to levels last seen in the 30s, central bankers around the world has, for some time, found a way to defy basic economic gravity. It’s like the financial crisis of 2007-2008 left central bankers shell-chocked and weak. Ben Bernanke was swift to lower the FED funds rate from 5.25% to 0.09%, a bazooka move which was, given the situation, probably an appropriate action - after all the bazooka have been loaded for a reason! After Ban and Hank Paulson went through the tough three weeks, day and nights convincing bank CEOs to collectively jump into a liferaft, filled to the brink with rose champagne and kaviar on glutenfree crackers. They got to work patching the various banks to their best abilities, luckily friend China provided 1 million ton of low quality duct tape, as a tank you for the 2 decades of indirect subsidies in the form of an asymmetric and unfair tariff system. Getting all the wallstrees and congress egos in-line, has without a doubt been an energy depleting endevour, actually so exhausting that Ben simply fell asleep at the switch for the next 6½ years!

On the other side of the pond, things are unfortunately not better. The ECB, effectively functioning as the piggy-bank of all it’s member states, collectively know as the dysfunctional family or more formally the European Union, is joggling an impossible amount of balls, and suffering from the classic fallacy, that it’s easy to give and difficult to take. This leads to solutions that fits the financially lowest denominator e.g. with the allowance of Italy to include estimated revenue originating from crime! As well as the collective credit ratings, allowing the southern economies to obtain much cheaper loans.

Everybody hates the hang-over following a party, but just keep drinking is not really a sustainable solution, but somehow this simple logic does not apply to central banking. The hangover phase for the economy is to increase interest rates slow but steady - Say what! No body likes this! It stops the economy from growing like uncontrolled wild fire! The phase for the financial system is called deleverage - Oh my! Bring the silver and garlic! It shrinks the banks profitability, make investors refurbish their yacht instead of buying a new one as well as making the stock-picking hedge fund managers think twice before buying a football club.

In the aftermath of the financial crisis of 2007-2008, independent government commissions, academics and politicians from around the world came up with new and more complicated regulation of the financial sector. Most of it was focusing on the exact circumstances leading the the crisis, as referred to in statistics overfitting which equals useless. A few big improvements was implemented

- Separation of banks proprietary trading and their deposits (Yes! Before 2008, many banks made leveraged bets with the money you had in your account, through what was known as internal hedge funds).

- “Iron clad” and clear capital requirements for banks. Well, depending on their interconnectedness, size of balance sheet and risk of assets they are holding.

The separation of activities just made sense, in order to shield the “real economy” from future financial meltdowns, and seems largely to have been a success.

The capital requirements, oh year, that’s a different story! In short: This is the amount of capital a bank need to put aside in order to make a loan, it’s the self-insurance or buffer to be used if the loan goes bad. In an attempt to not penelize parts of the economy by demanding too high a capital requirement, e.g. a utility company like a power plant is rock solid and will diligently pay off their loan over the next 30 years, how ever a holiday company is a consumer cyclical business, their success next summer depends on things like timing of marketing, reputation and future economic outlook for customers to book their holidays. The capital requirement of the first will be low and the latter high, smoothning things out and leaves the banks with a diversified loan portfolio, or well that’s atleast the intention. No two companies are alike and it would be unfair to treat the 80 year old industry veteran with the new LBO’ed more-market-share-at-any-cost entrant, and individual adjustments is therefore allowed, well as long as it can be defended. So what about lowering the default risk for companies in the accommodation space, afterall they now have a stable income in the form of government support, and no longer subject to cyclical holiday seasons.

On the 2th of July 2021, the head of the ECB’s banking supervisory arm, Andrea Enria, said

Not all banks have adapted their models to account for exposure to firms in the most affected sectors such as accommodation and food. We were concerned, and somewhat surprised, to see that some banks have even lowered those default probabilities, potentially reflecting the impact of public support measures. (source: ECB’s Enria warns eurozone banks over risk-taking)

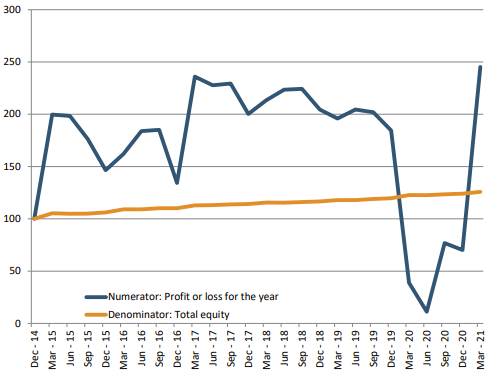

European Banking Authority (EBA) reported in their Q1 2021 risk dashboard, a sharp rise in the profitability of the European banks.

Profitability improved strongly. Return on equity (RoE) rose to 7.6% in Q1 2021 from 1.9% as of YE2020, an all time high for the periods covered by the Risk Dashboard (since 2014), driven by contracting cost of risk as well as rising fee & commission and trading income. (source: EBA Risk Dashboard, Q1 2021)

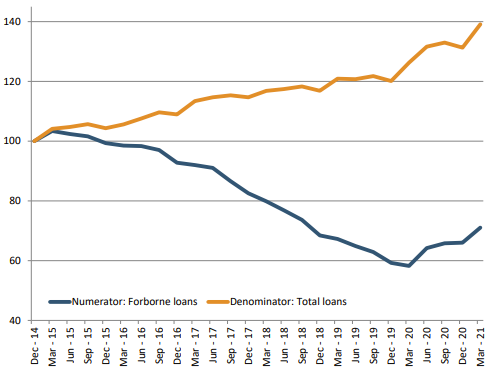

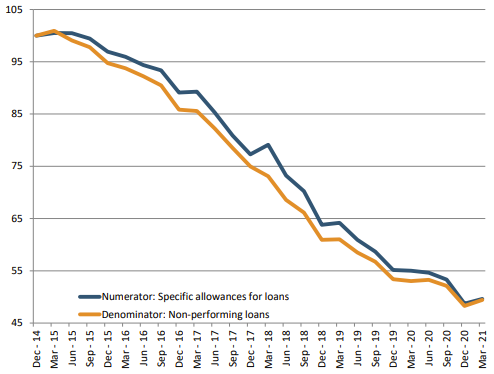

So we have a world-wide pandemic, but the very business that’s ingrained in the economy is doing phenomenal, how can this be? Clues are hiding in plain sight, with a gram of interpretation “contracting cost of risk” is just another way of saying risk is being reduced as governments implicitly guarantees to keep the debtor above water. If that’s not enough there’s always forbearance! Say what? Fancy word for an agreement between the bank and debtor, that keeps the loan in good standing, despite it’s not being paid off and hence is non-performing, this can postpone or avoid a bankrupcy / foreclosure, as an added benefit it keeps the banks balance sheet shiny as no write-off is needed.

Banks effectively got a vaccine of their own making them immune towards bad loans, and so the party can continue.

Reality check and new cracks

Even the most drunk bank CEO can see the stockmarket is glowing red-hot, the weighted P/E ratio of the 601 North American companies in the industrials sector is 34.5 (source: 7th of July 2020, finviz), that’s hot or better said: Overpriced!

Money is like water, it needs to go somewhere, just sitting on it makes you a victim of purchase power erosion due to the impact of inflation, charging your customers the same negative interest rate as the inflation makes no friends! So what to do? Loan the money into the “real-economy” and potential get more bad, I mean good, ah let’s just call it zombie loans? Or finance speculation in the stock/equity or derivatives markets - looks pretty-darn-risky!

Reverse Repo

On the 17th of June the FED increased their overnight reverse repo (in simple terms, an account at the central bank) rate by 0.05% (source: Credit Suisse - Global Money Dispatch) and immediately attracted $320 billion more in deposits (with a total of $755.8 billion (source: Reuters: NY FED - Daily reverse repo operation). This basically means the best option to generate a yield on the liquidity used day-to-day in some of the banks is to get a risk-free 0.05% yield or a riskier 0.085% in the interbank market (source: Overnight USD LIBOR), that’s not much! It’s difficult to be precise with what’s a healthy rate. Historically the range of 2 - 3.5% has been the middle way between crisis and recession. In anycase the current rates is a world apart of anything that makes long-term sense.

The extreme pressure on the LIBOR overnight rates is a clear indication of excess liquidity building up, both the attempt by the FED to help take the pressure off the boiler, in the form of increased repo rate and the fact that $40 billion of the $320 billion deposited was freshly minted quantitative easing money - seriously, this is money being “printed” send into the economy, just to be returned like a boomerang back to the FED, this is a system that choking!

Friend Andrea’s lifted finger

Then again on the 2nd of July, Andrea Enria, was out with a warning.

…warning signs of increasing leverage, financial complexity and opacity creating the potential for a dangerous combination of risk factors…

and

In key areas such as leveraged finance, where previous supervisory guidance has not been sufficiently implemented by banks, we plan to deploy the full range of supervisory tools available to us, including minimum capital requirements commensurate with the specific risk profile of individual banks, should this become necessary

and

Concrete signs of risk build-up have in our view become apparent in the risky asset segments of leveraged debt and equity-related derivatives, which warrant intensified supervision (source: ECB to crack down on dangerous risks in banks’ leveraged lending)

So in short: The risk offsetting among banks is too complicated, opaque and with too high leverage, especially within leveraged finance and equity derivatives. To no surprice Deutche Bank is mentioned by name. But what is actually being said is: Start deleverage your books, we will be visiting soon, and Deutche if you act like your not home - we know your are lying!

Latest batch of crack-cocaine arrives

2th of April 2020, the FED announced they would invoke the “supplementary leverage ratio” rule (source: FED: Regulators temporarily change the supplementary leverage ratio…), made in the aftermath of the global financial crisis of 2007-2008, allowing big banks to have a leverage ratio of just 3% and systematically important bank holding companies (known as GSIBs, if anybody is interested) to have 5% It took 168 days for ECB to pick-up on the idea, give it a different name: “leverage ratio relief”, and then slam a nice round flat 3% requirement through (source: ECB: Exceptional circumstances justify leverage ratio relief).

Putting this into context, Lehmann Brothers had a leverage ratio of 3.22% (remember: lower is worse) when it’s inventory of MBS products caused it to come tumbling down (source: Wikipedia: Bankruptcy of Lehman Brothers).

The chinese Icarus investors

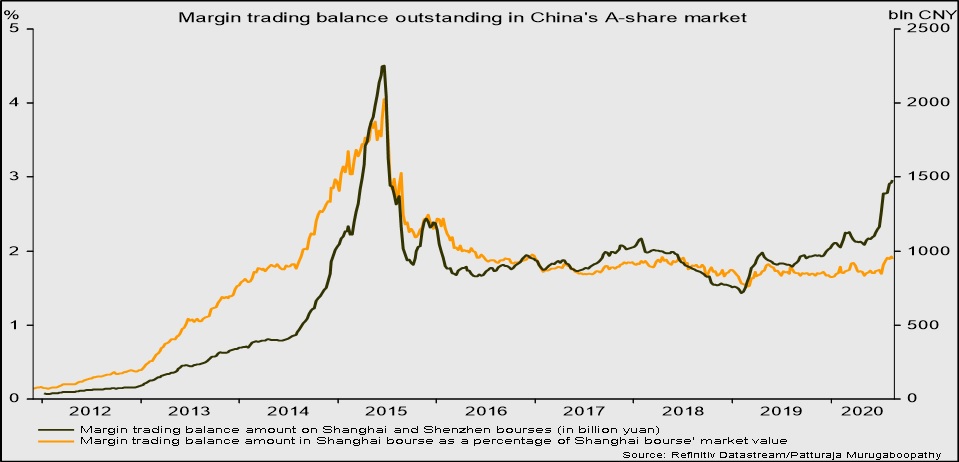

No two crashes is the same, but I vividly remember reading reading about the Chinese market regulators imposing a margin cap of “only” 25% (4 times leverage!) for retail investors (source: China market regulator seeks to cap margin trading, short selling), and thinking: oh fuck! Now it’s coming down! It’s aways tricky to use past events to predict the future, but to illustrate what happens during a (rapid) deleverage phase, let’s have a look at what happened to the Shenzen Composite Index in the before, during and after such an event.

The chinese crackdown on leverage led to a crash, but due to Chinas economic isolation, the spill over to the western financial system was limited, with mostly participants with emerging market exposure being hit.

So what to do?

The hardliner would say: Short the market! But the good old classic saying: “The market can be irrational longer than you can say solvent” still holds to this day. Shorting the market in our current environment would be like staring a T-rex into intimidation - you can try if you want to, and if you win you have serious cojones, if not you where dumb!

To deal with the current confusing situation, I think it’s safer and simpler to just look at the future being volatile. Therefore I believe more in designing an options strategy, around key events that can act as catalysts for bigger market moves. Especially call options on the VIX is interesting, but straddle or a strangle strategy on one of the bigger indices is also a great choice.

From my point of view the next interesting event is the FED FRN/Note summer auction, which runs between 22th to 24th of June 2021, this is an excellent time for funds to take profits from their equities positions and move the proceeds into a “safe” asset like short dated notes. It’s also a great time for clearing banks to reduce their leverage, as the excess capital can be allocated into an asset regarded, as good as “hard currency”, atleast when calculating capital requirements!

On the same day as the first auction (22th of June) the governing council of ECB is meeting and presenting their “new guidance on monetary stimulus” (source: ECB’s Lagarde Foresees July Policy Shift, 2022 ‘Transition’), that will undoubtedly have a positive outcome, and probably have a summery in the lines of: “We’ll keep the printer running a bit longer!”

Look out for:

- Issuance amount Vs. amount at the May auction - this is indicative for the appetite indicated by the market. Will be available on 17th of June (the announcement day).

- Price for big ETFs above/below NAV (Net-Asset-Value) indicating big asset managers moving in/out.

If or when the inflation begin to rampant (significant above target) and the central banks start with reductive measures, the T-rex from above will start to look more like a kangaroo, still strong but manageable.

End notes

In this mini-essay, I might come across, as critical to the financial markets, but nothing could be further from the truth. The free financial market does exactly what it’s best at: allocating capital in the most efficient way possible given the rules and regulation imposed. When those rules and regulations has long term destabilising effect, we sooner or later end up in a mess.